Flagstaff AZ property records offer a treasure trove of information for residents, researchers, and investors alike. Understanding these records unlocks insights into property values, ownership history, and neighborhood trends. This guide navigates the complexities of accessing, interpreting, and utilizing this valuable data, empowering users to make informed decisions.

From online portals to county offices, multiple avenues exist to access Flagstaff’s property records. Each method presents unique advantages and disadvantages, impacting the ease and efficiency of data retrieval. This guide will detail the various access points, highlighting the most effective strategies and potential challenges users might encounter. Furthermore, we will explore the diverse applications of this data, from tracking property ownership changes to conducting in-depth neighborhood analyses.

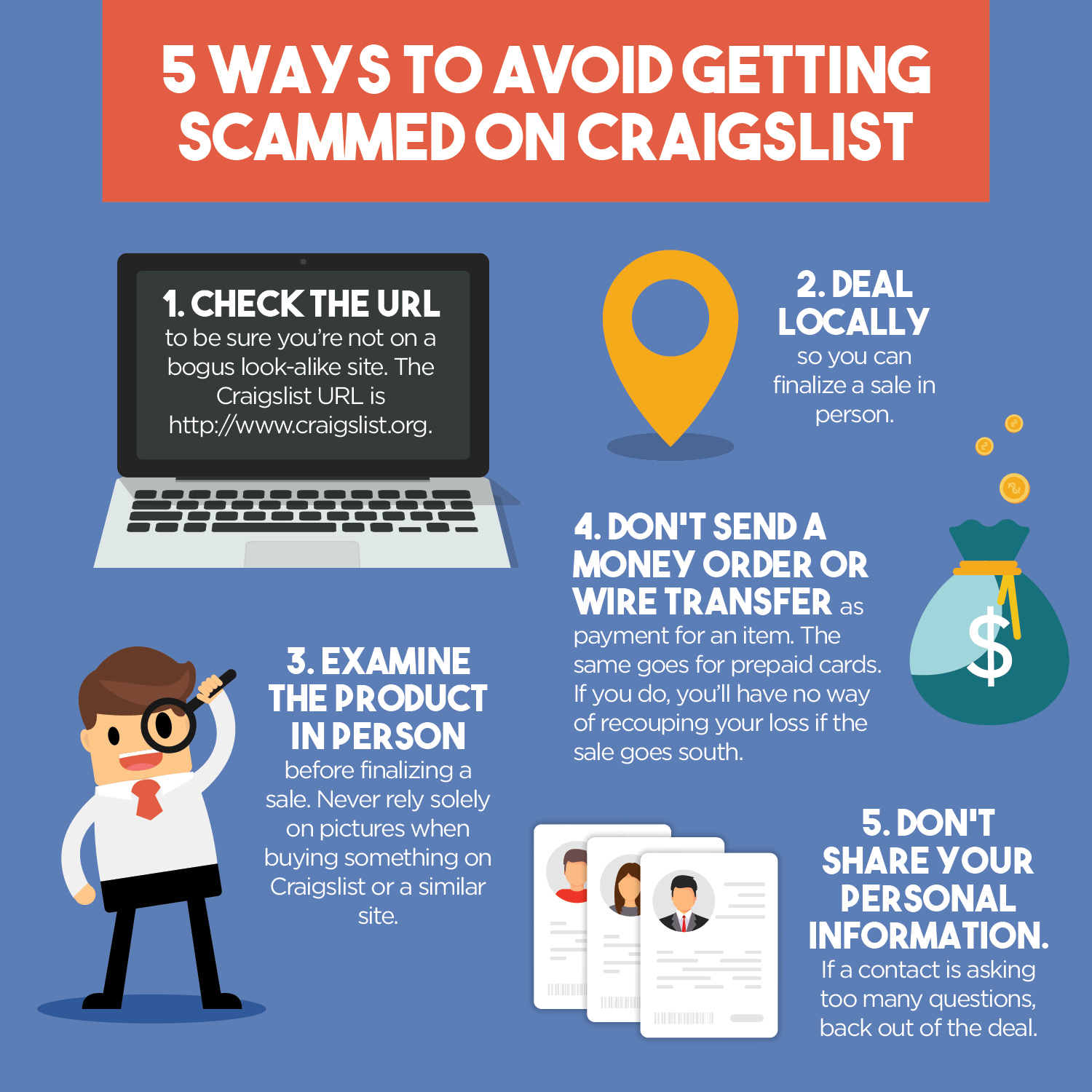

Check what professionals state about craigslist san bernardino california and its benefits for the industry.

Understanding Flagstaff AZ Property Records Data

Flagstaff, Arizona property records contain a wealth of information crucial for various purposes, from assessing property value to conducting neighborhood analyses. Understanding the structure and content of these records is essential for effective utilization. This section details the types of data available, their sources, and typical fields included, categorized for clarity.

Types and Sources of Flagstaff AZ Property Records Data

Flagstaff AZ property records data encompasses details regarding ownership, assessment, location, and property characteristics. The primary source is the Coconino County Assessor’s Office, which maintains a comprehensive database updated regularly. Supplementary data might be sourced from the Coconino County Recorder’s Office (for deeds and ownership history) and various third-party providers offering aggregated property information.

Typical Fields in a Property Record

Property records typically include a wide range of data fields, categorized for easier understanding. These categories and example fields are:

Ownership Information

- Owner Name(s)

- Mailing Address

- Ownership Date

- Deed Type

Assessment Information

- Assessed Value

- Taxable Value

- Tax Rate

- Tax Year

Location Information

- Property Address

- Legal Description

- Lot Size

- GPS Coordinates

Property Characteristics, Flagstaff az property records

- Building Square Footage

- Number of Bedrooms/Bathrooms

- Year Built

- Property Type (Residential, Commercial, etc.)

Sample Property Record Entry

| Field | Data Type | Example Value |

|---|---|---|

| Owner Name | Text | John & Jane Doe |

| Property Address | Text | 123 Aspen Ave, Flagstaff, AZ 86001 |

| Assessed Value | Numeric | $500,000 |

| Year Built | Numeric | 1995 |

Accessing Flagstaff AZ Property Records

Accessing Flagstaff property records can be achieved through several methods, each with its advantages and disadvantages. Understanding these options allows users to choose the most efficient approach based on their needs and technical capabilities.

Methods for Accessing Records

There are three primary methods to access Flagstaff AZ property records:

- Online Portals: The Coconino County Assessor’s website provides an online search portal. This is generally the most convenient and readily accessible method.

- Government Offices: Records can be accessed in person at the Coconino County Assessor’s Office. This allows for direct interaction with staff but requires travel and may have limited hours of operation.

- Third-Party Websites: Several commercial websites aggregate property data, often providing additional features like property value estimates and historical trends. However, accuracy and completeness can vary, and fees may apply.

Accessing Records via the Coconino County Website

The Coconino County Assessor’s website typically provides a search bar allowing users to input property addresses or owner names. After inputting the search criteria, users are presented with a list of matching properties. Selecting a property will display the detailed record. Challenges might include website downtime, incomplete data, or difficulties navigating the website interface.

Step-by-Step Guide for Efficient Access

- Visit the Coconino County Assessor’s official website.

- Locate the property search function.

- Enter the property address or owner name.

- Review the search results and select the correct property.

- View the detailed property record.

Interpreting Flagstaff AZ Property Records

Understanding the terminology and potential inconsistencies within Flagstaff AZ property records is crucial for accurate interpretation. This section clarifies key terms, discusses potential discrepancies, and explains the implications of different property classifications.

Key Terms and Abbreviations

Commonly used terms include “Assessed Value” (the value assigned by the county for tax purposes), “Taxable Value” (the assessed value minus any exemptions), and “Legal Description” (a precise legal description of the property’s boundaries). Abbreviations may include “sq ft” (square feet), “res” (residential), and “comm” (commercial).

Potential Discrepancies and Inconsistencies

Data inconsistencies may arise from data entry errors, updates not reflecting current conditions, or differences in interpretation. Cross-referencing data from multiple sources can help mitigate these discrepancies. For example, comparing assessed value with recent sales prices of similar properties can reveal potential inconsistencies.

Property Classifications and Tax Implications

Property classifications (residential, commercial, agricultural, etc.) significantly influence tax rates. Residential properties generally have different tax rates compared to commercial or industrial properties. Understanding these classifications is vital for accurately interpreting property tax assessments.

Interpreting Property Tax Assessments

Property tax assessments are calculated based on the assessed value and the applicable tax rate. The formula is generally: Tax = Assessed Value x Tax Rate. This calculation can vary based on location and property type within Flagstaff.

Comparison of Property Tax Rates

| Property Type | Location | Approximate Tax Rate (Example) |

|---|---|---|

| Residential | Downtown Flagstaff | 1.5% |

| Commercial | Downtown Flagstaff | 2.0% |

| Residential | Suburban Flagstaff | 1.2% |

Utilizing Flagstaff AZ Property Records for Research

Flagstaff AZ property records are a valuable resource for various research purposes, from tracking ownership history to conducting neighborhood analyses. This section demonstrates how these records can be utilized effectively while adhering to ethical considerations.

Tracking Property Ownership History

By reviewing property records, researchers can trace the history of ownership for a specific property. This can reveal patterns of ownership changes, periods of vacancy, or potential disputes. This information can be valuable for historical research or due diligence purposes.

Neighborhood Analysis

Property records can be used to analyze neighborhood characteristics. Data on average home values, property sizes, and property types can provide insights into neighborhood trends and dynamics. This data can be used to support real estate market analysis or urban planning studies.

Identifying Properties Meeting Specific Criteria

By filtering property records based on criteria such as price range, property type, and size, researchers can identify properties meeting specific requirements. This is valuable for real estate investment analysis or for identifying potential properties for purchase or sale.

Ethical Considerations

Researchers should be mindful of ethical considerations when using property records. Respecting privacy and avoiding the misuse of personal information is paramount. Data should be used responsibly and ethically, in accordance with any applicable regulations and privacy laws.

Research Plan: Property Value Trends

A research plan to analyze property value trends over the past decade in Flagstaff could involve collecting assessed values from property records for a sample of properties across different neighborhoods. This data can then be analyzed to identify trends in property value appreciation or depreciation, potentially correlating these trends with market factors or neighborhood characteristics. Data visualization techniques, such as line graphs, could be used to present the findings.

Visualizing Flagstaff AZ Property Data

Visualizing Flagstaff AZ property data through charts and maps enhances understanding and facilitates communication of findings. This section describes methods for creating effective visual representations of property information.

Visualizing Property Values Across Neighborhoods

A bar chart could effectively display the average property values across different neighborhoods in Flagstaff. Each bar would represent a neighborhood, and the bar height would correspond to the average property value. This visual representation would quickly highlight variations in property values across the city.

Distribution of Property Sizes

A histogram could effectively illustrate the distribution of property sizes in Flagstaff. The x-axis would represent property size ranges (e.g., 0-1000 sq ft, 1001-2000 sq ft, etc.), and the y-axis would represent the number of properties within each range. This would show the frequency of different property sizes.

Visualizing Property Locations and Values

A thematic map could effectively display property locations and values. Each property could be represented by a point on the map, with the point color or size reflecting the property value. This would provide a spatial visualization of property values across Flagstaff, highlighting areas with higher or lower values.

Illustrative Map Showing Property Values

An illustrative map could use color intensity to represent property values. Areas with higher property values could be shown in darker shades, while areas with lower values would be lighter. This would provide a visual representation of the spatial distribution of property values across Flagstaff.

Change in Property Tax Assessments Over Time

A line graph could effectively show the change in property tax assessments over time. The x-axis would represent time (e.g., years), and the y-axis would represent the average property tax assessment. This would illustrate trends in property tax assessments over time.

Mastering Flagstaff AZ property records empowers individuals with crucial information for informed decisions related to real estate. Whether researching property values, analyzing neighborhood trends, or tracing ownership history, the data offers a wealth of insights. By understanding the various access methods, interpreting key terms, and adhering to ethical considerations, users can leverage these records for informed decisions and effective research.