Comenity card victoria secret – Comenity Card Victoria’s Secret: This retail credit card offers a blend of perks and potential pitfalls for consumers. Understanding its features, rewards program, and associated risks is crucial before applying. This in-depth analysis explores the card’s benefits, drawbacks, and the application process, providing readers with the necessary information to make an informed decision.

From application requirements and approval processes to managing accounts and maximizing rewards, we delve into every aspect of the Comenity Victoria’s Secret credit card. We’ll compare it to other retail cards, analyze its rewards program, and discuss strategies for responsible usage to avoid potential debt. This comprehensive guide aims to equip consumers with the knowledge needed to navigate the complexities of this specific credit card offering.

Comenity Bank and Victoria’s Secret Credit Card

The Comenity Victoria’s Secret credit card offers a rewards program tailored to shoppers of the brand. This article provides a comprehensive overview of the card’s features, application process, rewards program, account management, customer service, potential risks, and visual design. Understanding these aspects will help potential applicants make an informed decision.

Comenity Victoria’s Secret Credit Card Features

The Comenity Victoria’s Secret card is a retail credit card offering rewards specifically for purchases made at Victoria’s Secret stores and online. Key features typically include a rewards program, special financing offers (potentially varying throughout the year), and the convenience of consolidating purchases into one account. However, it’s crucial to note that interest rates and fees can be higher compared to general-purpose credit cards.

Benefits and Drawbacks of the Victoria’s Secret Credit Card

The primary benefit is the rewards program, allowing cardholders to earn points on Victoria’s Secret purchases, potentially leading to discounts or other perks. However, drawbacks include higher interest rates than many general-purpose cards and potential for accumulating debt if not managed responsibly. The rewards are limited to Victoria’s Secret purchases, restricting their utility compared to cards offering broader rewards.

Comparison to Other Retail Credit Cards

Compared to other retail credit cards, the Comenity Victoria’s Secret card’s appeal hinges on its specific rewards program focused on a single brand. Other retail cards might offer broader rewards or benefits, potentially making them more versatile. A careful comparison of interest rates, fees, and rewards across various retail cards is necessary before deciding.

Situations Where This Card is Beneficial

This card proves beneficial for frequent Victoria’s Secret shoppers who prioritize earning rewards on their purchases. The rewards program can offer significant savings for those regularly buying from the brand. However, for infrequent shoppers or those who prefer broader rewards options, a general-purpose credit card might be a better choice.

Interest Rates, Fees, and Rewards Comparison

The following table shows a sample comparison of interest rates, fees, and rewards across different years. Note that these figures are illustrative and may vary depending on the cardholder’s creditworthiness and the specific terms offered by Comenity Bank. Always refer to the official Comenity Bank website for the most up-to-date information.

| Year | Annual Percentage Rate (APR) | Annual Fee | Rewards Points per $1 Spent |

|---|---|---|---|

| 2022 | 24.99% – 29.99% | $0 | 1 point |

| 2023 | 25.24% – 29.74% | $0 | 1 point |

| 2024 (Projected) | 26% – 30% | $0 | 1 point |

| 2025 (Projected) | 26% – 30% | $0 | 1 point |

Application and Approval Process

Applying for the Comenity Victoria’s Secret credit card involves a straightforward online application process. Understanding the requirements and potential reasons for denial is crucial for increasing the chances of approval.

Application Requirements

Applicants typically need to be at least 18 years old, a US resident, and possess a valid Social Security number. A minimum credit score is usually required, although the specific threshold isn’t publicly disclosed. Providing accurate and complete information during the application process is essential.

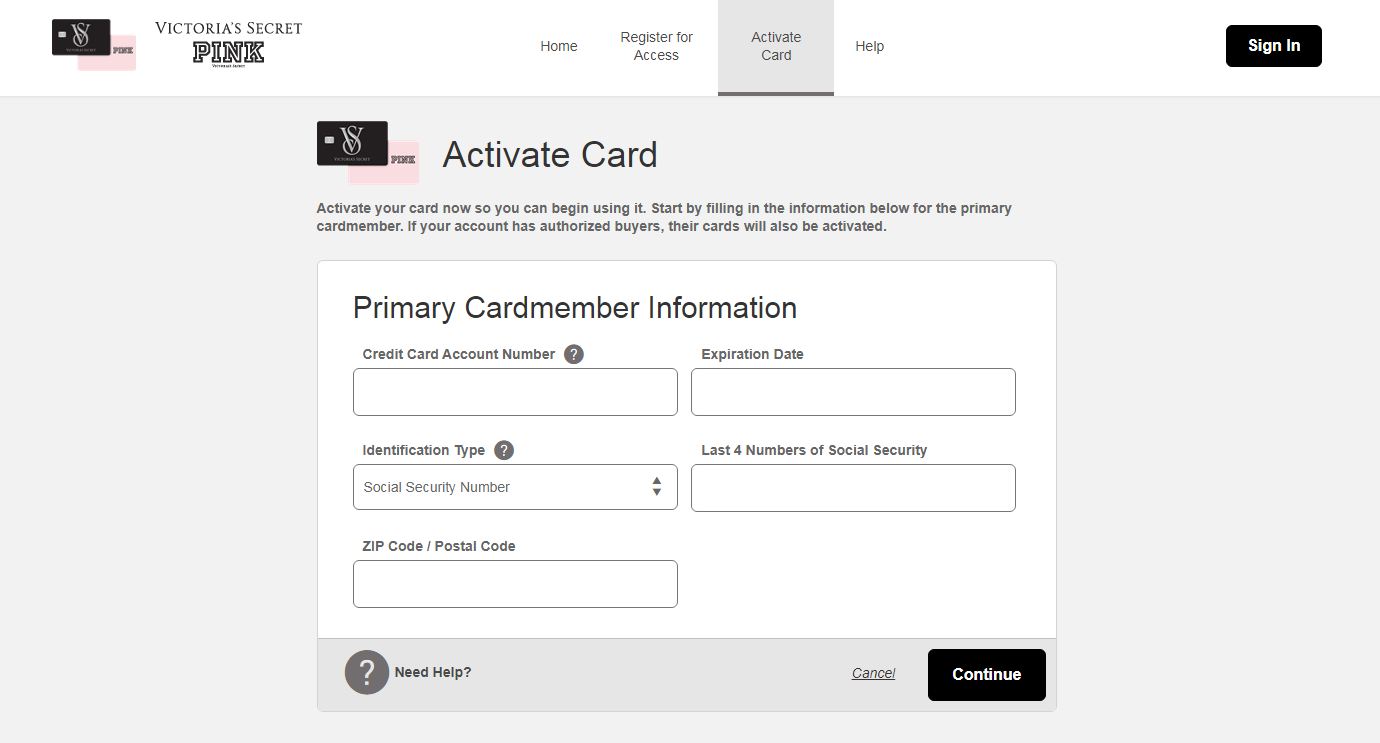

Steps Involved in the Application Process

The application process usually involves completing an online application form, providing personal and financial information, and undergoing a credit check. Applicants are typically notified of their approval or denial within a short timeframe. If approved, the card will be mailed to the provided address.

Reasons for Application Denial, Comenity card victoria secret

Common reasons for application denial include poor credit history, insufficient income, or inaccurate information provided on the application. Applicants with a history of late payments or high credit utilization are more likely to be denied. Reviewing one’s credit report before applying can help identify and address potential issues.

Application Process Flowchart

The application process can be visualized as follows: Application Submission -> Credit Check -> Approval/Denial -> Card Issuance (if approved).

Credit Score Requirements and Impact on Approval

While the exact credit score requirement isn’t publicly stated, a higher credit score generally increases the chances of approval and may lead to more favorable terms, such as a lower interest rate. Checking and improving one’s credit score before applying is recommended.

Rewards Program and Benefits

The Victoria’s Secret credit card’s rewards program centers around earning points on purchases. Understanding how points are earned and redeemed is key to maximizing its benefits.

Rewards Program Details

Cardholders typically earn one point for every dollar spent at Victoria’s Secret. These points can be redeemed for discounts on future purchases. The specific redemption values and available rewards may vary over time.

Rewards Point Earning and Redemption

Points are automatically accumulated with each Victoria’s Secret purchase. Redemption options are usually presented at checkout online or in-store. Cardholders can choose to redeem points for a specific dollar amount off their purchase.

Comparison to Other Retail Card Rewards

Compared to other retail credit card rewards programs, the Victoria’s Secret card offers a focused approach, rewarding purchases within a specific brand. Other programs might provide more flexibility with rewards redemption or broader earning opportunities.

Maximizing Rewards Point Earning

To maximize rewards, cardholders should concentrate their Victoria’s Secret purchases on this card. Using the card for all eligible purchases ensures the accumulation of the maximum number of reward points.

Best Ways to Use the Rewards Program

- Use the card for all Victoria’s Secret purchases.

- Redeem points strategically for larger purchases to maximize savings.

- Stay informed about any special promotions or bonus point offers.

Managing the Account and Payments

Responsible account management is crucial for avoiding late payment fees and maintaining a good credit score. Understanding payment options and account access methods is essential.

Payment Methods

Payments can typically be made online through the Comenity Bank website, by phone, or by mail. Autopay options may also be available for convenient automatic payments.

Accessing Account Statements Online

Account statements are usually accessible online through the Comenity Bank website. Cardholders can log in using their account number and password to view their transaction history and account balance.

Tips for Responsible Credit Card Management

Always pay your balance on time to avoid late payment fees and negative impacts on your credit score. Keep track of your spending to avoid exceeding your credit limit. Pay more than the minimum payment whenever possible to reduce your balance faster.

Avoiding Late Payment Fees

Set up automatic payments or reminders to ensure timely payments. Monitor your due date and make payments well in advance to avoid any processing delays.

Disputing a Charge

To dispute a charge, contact Comenity Bank customer service immediately. Provide details of the transaction and any supporting evidence, such as receipts or transaction records.

Notice oregon coast craigslist for recommendations and other broad suggestions.

Customer Service and Support: Comenity Card Victoria Secret

Comenity Bank offers various channels for customer service support. Understanding these channels and how to effectively interact with customer service can help resolve issues efficiently.

Customer Service Channels

Customer service is typically available via phone, online chat, and email. The Comenity Bank website usually provides contact information and FAQs.

Contacting Customer Support

Contact information is typically found on the Comenity Bank website or on your credit card statement. Be prepared to provide your account number and other relevant information when contacting customer service.

Common Customer Service Issues

Common issues include questions about billing statements, disputing charges, and resolving account-related problems. Technical difficulties accessing the online account portal are also frequently reported.

Strategies for Resolving Issues Effectively

Be polite and provide clear and concise information when contacting customer service. Keep records of all communications, including dates, times, and the names of representatives you spoke with.

Best Practices for Interacting with Customer Service

Always remain calm and respectful when communicating with customer service representatives. Clearly explain your issue and provide any necessary documentation to support your claim. Keep records of all interactions for your reference.

Potential Risks and Considerations

Retail credit cards, while convenient, carry inherent risks if not managed responsibly. Understanding these risks and employing responsible spending habits is crucial.

Potential Risks of Retail Credit Cards

High interest rates, accumulating debt, and the temptation for impulsive spending are significant risks. The limited utility of rewards points (specific to one retailer) also poses a limitation.

Importance of Responsible Credit Card Usage

Responsible usage involves tracking spending, paying balances on time, and avoiding exceeding the credit limit. Budgeting and creating a spending plan are essential for managing retail credit cards effectively.

Consequences of High Credit Utilization

High credit utilization negatively impacts credit scores, making it harder to obtain loans or credit in the future. It also increases the risk of accumulating significant debt.

Avoiding Debt with Retail Credit Cards

Avoid using retail credit cards for non-essential purchases. Pay off your balance in full each month to avoid interest charges. Create a budget and stick to it to control spending.

Scenarios Where This Card Might Not Be the Best Option

If you are not a frequent Victoria’s Secret shopper, a general-purpose credit card with broader rewards or lower interest rates might be more suitable. If you struggle with managing debt, avoiding retail credit cards altogether is advisable.

Visual Representation of Card Features

The visual design of the Victoria’s Secret credit card contributes to its brand appeal. The card’s aesthetics are likely intended to resonate with the target demographic.

Visual Elements of the Victoria’s Secret Card

The card likely features a predominantly pink or a color associated with the Victoria’s Secret brand. The Victoria’s Secret logo is prominently displayed, along with the Comenity Bank logo. The card likely incorporates a sleek and modern design.

Appeal to Target Demographic

The card’s visual design, with its likely use of pink and a sophisticated aesthetic, aims to attract the brand’s target demographic: women who appreciate the Victoria’s Secret brand and its image.

Comparison to Competitors’ Cards

Compared to competitors, the Victoria’s Secret card’s design likely emphasizes the brand’s identity, potentially differing from cards that focus on more neutral or universal designs.

Physical Appearance Description

Imagine a sleek, rectangular card. The dominant color is likely a shade of pink, possibly with subtle variations in tone. The Victoria’s Secret logo, recognizable for its elegant script, is centrally placed, perhaps slightly elevated or embossed. The Comenity Bank logo is smaller and less prominent, possibly located on the back or in a corner. The card number, expiration date, and security code are clearly printed, adhering to standard credit card format.

The overall feel is likely smooth and subtly textured, suggesting a premium feel consistent with the Victoria’s Secret brand image.

The Comenity Victoria’s Secret credit card presents a compelling option for loyal Victoria’s Secret shoppers, offering rewards tailored to their spending habits. However, responsible use is paramount. Understanding the terms and conditions, managing credit utilization, and carefully considering the potential risks associated with retail credit cards are key to maximizing benefits and avoiding financial pitfalls. Ultimately, the decision to apply rests on a thorough evaluation of individual financial needs and spending patterns.